Business Insurance in and around Patchogue

Searching for protection for your business? Look no further than State Farm agent Ken Kortright!

No funny business here

Help Protect Your Business With State Farm.

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent Ken Kortright, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

Searching for protection for your business? Look no further than State Farm agent Ken Kortright!

No funny business here

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your compensation, but also helps with regular payroll overhead. You can also include liability, which is crucial coverage protecting your company in the event of a claim or judgment against you by a consumer.

Contact the wonderful team at agent Ken Kortright's office to find out about the options that may be right for you and your small business.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

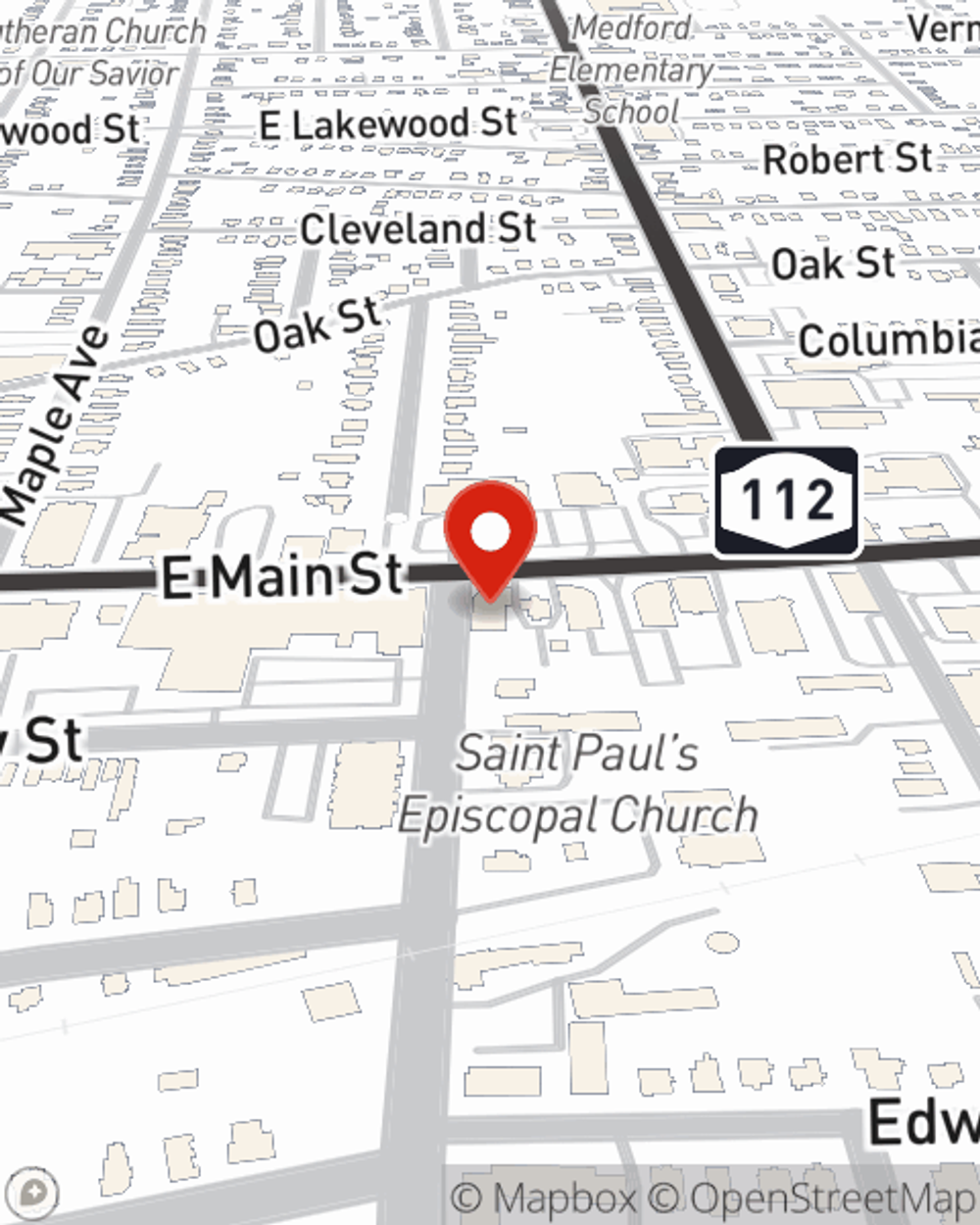

Ken Kortright

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.